Each year by October 15th the State of Florida determines what the following year’s minimum wage rate will be. Take a minute to check your calendar – we can expect this announcement soon! While many would like to think these decisions are completely left to politics and protesters, the minimum wage determination in Florida is actually made using a formula that ties the minimum wage to the consumer price index (CPI).[1]

Last October it was announced that there would be no minimum wage increase in Florida for 2016. The decision was a surprise to some, especially those in the hospitality industry which contains a large number of the state’s minimum wage workforce. However, since Florida has already established a minimum wage higher than the federal minimum, news of a flat year was welcomed by employers.

Employers in the hospitality industry have come to terms with Florida’s higher-than-federal minimum wage, but many struggle with the tipped minimum wage and how to ensure compliance when paying tipped employees. The current minimum wage in Florida is $8.05 per hour, with a minimum directly paid wage of at least $5.03 per hour for tipped employees (with tips making up the difference).

Employers in the hospitality industry have come to terms with Florida’s higher-than-federal minimum wage, but many struggle with the tipped minimum wage and how to ensure compliance when paying tipped employees. The current minimum wage in Florida is $8.05 per hour, with a minimum directly paid wage of at least $5.03 per hour for tipped employees (with tips making up the difference).

Thus, in Florida, the employer can claim $3.02 toward the $8.05 minimum wage as long as the employee actually receives $3.02 in tips per hour. If the employee does not receive $3.02 per hour in tips the employer must pay the difference so that the full minimum wage is met.

While we wait to see if the state minimum wage (as well as the tipped minimum wage and tip credit amounts) will change for next year, now is a good time to review related Department of Labor Rules.

To begin with, employers must provide tipped employees specific information from the start of employment[2]:

- Notice of the amount of direct hourly wages it is paying a tipped employee, which must be at least $5.03 in Florida

- The additional amount it claims as a tip credit, which cannot exceed $3.02

- An explanation that the tip credit it claims cannot exceed the amount of tips actually received by the tipped employee;

- A statement that all tips received by the tipped employee are to be retained by the employee unless there is a valid tip-pooling arrangement in place; and

- An explanation that the tip credit will not apply to any tipped employee unless the employee has been informed of the tip credit provisions.

Two aspects seem to be at the root of many tipped minimum wage and hour disputes: Dual jobs and tip pools.

Many employers don’t consider their tipped staff to have dual jobs. However, if tipped workers are expected to spend some of their shift completing work that does not provide tips, they may have a dual job. Take a server for example. The server may spend four hours waiting tables, but then two additional hours cleaning, taking inventory, stocking table condiments, etc. The employer must pay the server the full minimum wage, without taking a tip credit, for those two hours.[3]

Another issue is tip pooling. Although tip pooling has potential benefits for employees, it can also be misused by employers. While many believe that back-of-house staff (line cooks, dishwashers, bussers, etc.) deserve a cut of the tip for their role in the dining experience, this practice cuts wait staff tip wages by more than 50%, which is definitely not in accordance with the law. According to the Federal Department of Labor, only employees who regularly receive tips can be part of the pool and employees must receive notice that they will be pooling. The law says that employees cannot be required to share their tips with employees who do not receive their own tips, like dishwashers or cooks.[4]

Whether or not the minimum wage (and tipped minimum wage!) will change next year as a result of the CPI formula or the presidential election, employers should review their payroll practices to ensure compliance and minimize the chance of wage and hour issues!

[1] http://www.orlandosentinel.com/business/brinkmann-on-business/os-florida-minimum-wage-20151019-post.html

[2] http://hr.blr.com/HR-news/Compensation/FLSA-Fair-Labor-Standards-Act/Florida-court-FLSA-rules-valid-tip-credits-pools/#

[3] http://www.nolo.com/legal-encyclopedia/florida-laws-tipped-employees.html

[4] http://www.danzlaw.net/blog/2016/06/understand-the-tipped-minimum-wage-laws-and-common-florida-violations.shtml

The Federal Fair Labor Standards act defines special minimum wage rates applicable to certain types of workers. Employees may be paid under the Florida minimum wage if they fit into one of the following categories:

The Federal Fair Labor Standards act defines special minimum wage rates applicable to certain types of workers. Employees may be paid under the Florida minimum wage if they fit into one of the following categories: Contrary to popular belief, this program doesn’t simply wipe out college loan debt. The PSLF was designed to forgive the remaining balance on Direct Loans after 120 qualifying monthly payments have been made while working full-time for a qualifying employer.

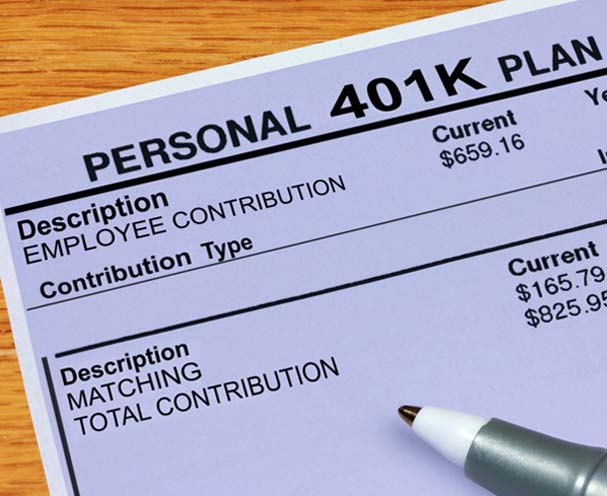

Contrary to popular belief, this program doesn’t simply wipe out college loan debt. The PSLF was designed to forgive the remaining balance on Direct Loans after 120 qualifying monthly payments have been made while working full-time for a qualifying employer. In short, the DOL’s definition of a fiduciary requires that financial advisors, salespersons, planners, agents and brokers act in the best interests of their clients, put their clients’ interests above their own and clearly disclose all fees and commissions in dollar form. The rule creates a much greater level of accountability than salespersons and others have seen in the past and would have had a significant impact on those who rely on commission based sales. Retirement planning for defined contribution plans (401(k), 403(b), employee stock ownership), defined benefits plans (pension plans) and IRA’s could have seen significant changes.

In short, the DOL’s definition of a fiduciary requires that financial advisors, salespersons, planners, agents and brokers act in the best interests of their clients, put their clients’ interests above their own and clearly disclose all fees and commissions in dollar form. The rule creates a much greater level of accountability than salespersons and others have seen in the past and would have had a significant impact on those who rely on commission based sales. Retirement planning for defined contribution plans (401(k), 403(b), employee stock ownership), defined benefits plans (pension plans) and IRA’s could have seen significant changes.

While a tradition in many places, some employers often question whether, when and how to offer holiday or year-end bonuses to employees. The decision to give a bonus – and the size of that bonus – may be tied to the company’s overall performance. Tradition or not, bonuses are gifts, not entitlements. If bonuses are a tradition in your workplace and you decide not to offer a bonus for financial or other reasons, you should communicate that fact to your employees as soon as possible since some may be making plans for that money (Think Clark Griswold & the Jelly of the Month Club!).

While a tradition in many places, some employers often question whether, when and how to offer holiday or year-end bonuses to employees. The decision to give a bonus – and the size of that bonus – may be tied to the company’s overall performance. Tradition or not, bonuses are gifts, not entitlements. If bonuses are a tradition in your workplace and you decide not to offer a bonus for financial or other reasons, you should communicate that fact to your employees as soon as possible since some may be making plans for that money (Think Clark Griswold & the Jelly of the Month Club!). One of the larger awards, more than a half a million dollars, was the result of owners who required servers to contribute a portion of their total tips back to the employer, who then distributed the money to cooks and dishwashers who were not tipped employees. Consequently, the employer paid servers less than the federal minimum wage of $7.25 as required. Additionally, the restaurant failed to pay required overtime wages to employees when they worked more than 40 hours in a week, and did not keep accurate records of all hours worked.

One of the larger awards, more than a half a million dollars, was the result of owners who required servers to contribute a portion of their total tips back to the employer, who then distributed the money to cooks and dishwashers who were not tipped employees. Consequently, the employer paid servers less than the federal minimum wage of $7.25 as required. Additionally, the restaurant failed to pay required overtime wages to employees when they worked more than 40 hours in a week, and did not keep accurate records of all hours worked. Employers in the hospitality industry have come to terms with Florida’s higher-than-federal minimum wage, but many struggle with the tipped minimum wage and how to ensure compliance when paying tipped employees. The current minimum wage in Florida is $8.05 per hour, with a minimum directly paid wage of at least $5.03 per hour for tipped employees (with tips making up the difference).

Employers in the hospitality industry have come to terms with Florida’s higher-than-federal minimum wage, but many struggle with the tipped minimum wage and how to ensure compliance when paying tipped employees. The current minimum wage in Florida is $8.05 per hour, with a minimum directly paid wage of at least $5.03 per hour for tipped employees (with tips making up the difference).

Restaurant operators already have a dizzying amount to manage without getting bogged down by payroll or wage and hour issues. The Fair Labor Standards Act (FLSA) provides

Restaurant operators already have a dizzying amount to manage without getting bogged down by payroll or wage and hour issues. The Fair Labor Standards Act (FLSA) provides  Wondering how these new rules impact your labor force, and what you can do to ensure you remain in compliance? We can help! Complete the form to your right or call and ask for help- one of our HR Consultants will be glad to sit with you and analyze the impact to your impact and recommend solutions for your particular situation. There is no one-size-fits-all solution to complying with this rule, as what is best for every business can vary depending on many factors.

Wondering how these new rules impact your labor force, and what you can do to ensure you remain in compliance? We can help! Complete the form to your right or call and ask for help- one of our HR Consultants will be glad to sit with you and analyze the impact to your impact and recommend solutions for your particular situation. There is no one-size-fits-all solution to complying with this rule, as what is best for every business can vary depending on many factors.

To make it easier for employees to save money for college, more companies are adding 529-plan perks to workplace-benefits packages. Some employers allow workers to fund these college-savings vehicles automatically via payroll. Others kick in matching contributions. The goal is to make saving for college akin to saving for retirement by providing some of the same incentives that encourage workers to contribute to 401(k) accounts.

To make it easier for employees to save money for college, more companies are adding 529-plan perks to workplace-benefits packages. Some employers allow workers to fund these college-savings vehicles automatically via payroll. Others kick in matching contributions. The goal is to make saving for college akin to saving for retirement by providing some of the same incentives that encourage workers to contribute to 401(k) accounts.